What I've Been Reading

Multimodal LMs, software vals/,M&A, and strategic qc investments

Reading:

Multimodal LM roundup: Unified IO 2, inputs and outputs, Gemini, LLaVA-RLHF, and RLHF questions By Nathan Lambert

What it’s about

2024 seems to be the year of multimodal hype. The author touches on implications of the hype, the multimodal model landscape, and training considerations/whitespace for multimodal models

Five Software M&A Observations for 2024 By Janelle Teng

What it’s about

“Taking into account recent trends, here are five observations on the M&A landscape as we enter 2024:

Sponsor-backed take-private deals still dominate, but multiples are starting to compress

Blockbuster M&A from strategics have slowed as a valuation strike-zone has emerged

Continued regulatory scrutiny brings “caveat emptor” and “caveat venditor” implications

Reduced stigma around M&A “soft landings” as operating and fundraising conditions get harder

AI opens the M&A aperture for tech as well as non-tech strategics”

The Puritans of Venture Capital By Kyle Harrison

What it’s about

Software deals (IMO particularly at the intersection of lifesci x AI) seem to be red hot with venture outcome defying valuations for early stage companies — but why?

The author dives into the bifurcating models for venture funds and identifies two main archetypes: Puritan funds (~200M-500M) and Capital Agglomerators ($1B+)

What it’s about

Strategic investment in quantum computing continues.

The funds will be used to accelerate the path towards achieving the world’s first universal fault-tolerant quantum computers, while also extending Quantinuum’s software offering to enhance commercial applicability.

OS/software offerings that can support tasks across classical & quantum computing may be a future focus area of strategic investment

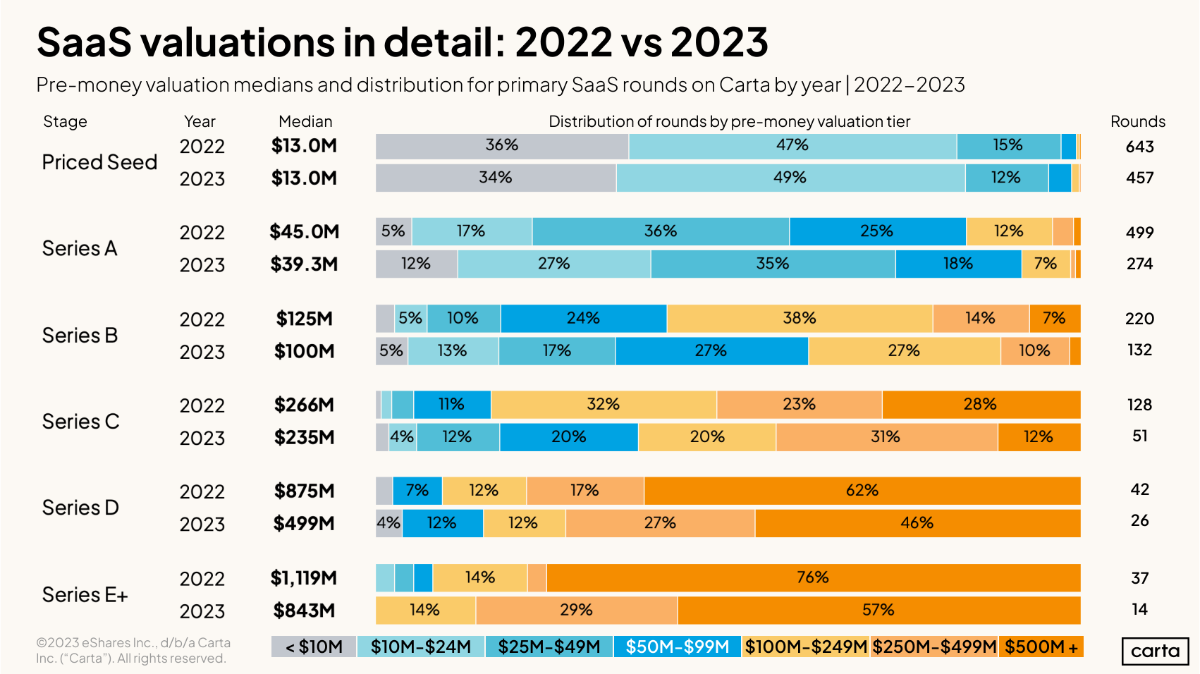

SaaS Evaluations By Carta Data Minute / Peter Walker